What stands between you and your business dreams? Is it the lack of funding for expansion, modernization, or talent acquisition? Many entrepreneurs visualize thriving businesses with multiple branches, satisfied customers, and innovative teams—yet financial constraints often transform these visions into distant mirages.

Ratnaafin Capital is here to bridge that gap.

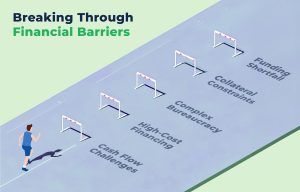

For India’s Micro, Small, and Medium Enterprises (MSME), the path to growth is riddled with financial obstacles:

Unsecured business loans are not just financial products—they are catalysts for transformation. Designed to empower entrepreneurs without the traditional collateral requirements, these loans enable you to:

In the fast-paced world of business, time is your most critical resource. Ratnaafin Capital delivers loan approvals within 48 hours, ensuring you never miss an opportunity.

We understand that every business is unique. Our approach is meticulously tailored to your specific needs:

Navigating financial decisions can be complex, but with Ratnaafin Capital, you’re never alone. Our team of seasoned financial experts is committed to guiding you through the loan process, providing insights and recommendations tailored to your business goals. With us, you’re not just a client; you’re a partner in success

Applying is refreshingly straightforward:

Every moment without proper funding is a missed opportunity for expansion, innovation, and market leadership. Ratnaafin Capital transforms financial constraints into strategic advantages.

Don’t let financial limitations define your entrepreneurial journey. Your vision deserves robust support.

Connect with Ratnaafin Capital Today

Unlock your business potential. Your future starts now.